We get lots of questions about lending and borrowing using NFTfi still, so in this new mini-series we’re going to dive a bit deeper on each side of the marketplace and explore some strategies and things for you to consider.

Lending first.

Lending on NFTfi is ultimately about providing liquidity to another user, the borrower. In our contract you as a lender exchange your loan in wETH for a claim to their NFT, which is used as collateral in the transaction.

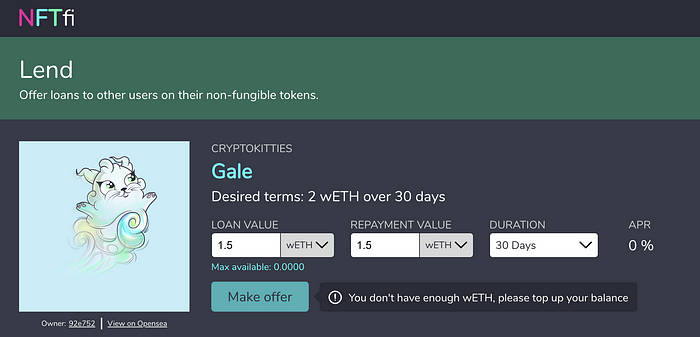

As a lender you set the loan value, the interest and the duration of the loan. That means we are in full control of our own risk, for good and bad. This piece aims to explore some of those factors in more detail and see how they play a role in different lending strategies.

- Lending for profit

The first one is the most obvious. Lend to other people to make a financial return. We think of this strategy as a competitive alternative to, say, being a liquidity provider on Uniswap. On the one side you avoid the risk of significant impermanent loss in smaller pools and on the other side NFTfi offers a significantly better return on your funds than any of the larger pools.

This approach has driven much of the initial usage of the platform, so it is also the one we understand best. Most loans on NFTfi so far has been agreed in the 40–100% APR range, demonstrating that lending to other users potentially offers very lucrative returns to increase your ETH (or DAI) stack over time.

Of course there are risks involved too, but managed well, NFTfi offers lenders a way to get outsized returns compared to other DeFi platforms, while at the same time retaining full control over their own risk. Unlike other loans we, as an example, don’t have to actually trust the borrower.

The key to making this strategy work is;

- Since we want to make a return, we want to make loans. The best way to achieve this is by making lots of loan offers, but maintaining a strict formula for the loans you make in order to minimize the risk of each loan. Once you sign for a certain NFT asset type once, making loan offers on those assets are free due to the use of wETH and your wETH isn’t tied up, similar to OpenSea offers. This means that there is no downside to us making tons of offers with our wETH, across many items.

- The Loan to Value (LtV) ratio is how much you offer as a loan amount, compared to how you and the market value that NFT. This is your most important tool for managing your risk, alongside the duration of the loan. If you set the loan value too high, you effectively offer the borrower an option to exit their NFT to you at that price over the course of the loan. And the longer the duration of the loan, the longer you are providing this option to the borrower, compounding your market risk.

- Make sure you feel comfortable that you could sell that NFT in 24–48 hours at a price that would recoup your loan or even make you a profit by selling. In this strategy we don’t want to get stuck with NFTs we foreclose. We’ve had NFTs flip for 2x to 4x of the loan value after foreclosure, so this element of the strategy, if executed well, actually offers you as a lender the possibility of outsized returns.

- Don’t make an offer on an NFT, if you don’t understand how to value it. Elements like last sale price is valuable, but can be misleading. It is worth clicking through to OpenSea to explore recent sales and floor price too. The flip side is that lenders that know how to value these NFTs can use their knowledge to price the asset accurately for loan to value vs risk and gain an advantage in that particular market.

- Longer loans (30–90 days) can be very profitable, but are best offered on NFTs that have demonstrated stable market value over a period of time.

- Make offers in either wETH or DAI (or both) depending on what exposure you want and how it fits your overall portfolio.

2. Lend to acquire

This approach has been used by a few of our users that are also extensive NFT collectors, but it could also be a very powerful way for e.g. a larger NFT DAO’s to acquire NFTs in an extremely cost-effective manner over time.

All the same risks apply, so we will have section 1 in mind while trying to explain how this approach to lending is different.

The key to making this strategy work is;

- We are not predominately trying to lend to people for a financial return when they pay us back, but for the opportunity to maybe acquire that NFT at a pre-determined price if the borrower defaults.

- First and foremost this means we should only make loan offers on NFTs we’d like to acquire, and only make loan offers for an amount that we’d be delighted for the borrower to default on. Our goal is acquisition.

- Loans that do pay back pay earn us fees, which will be used to pay for the NFTs we eventually foreclose, making new acquisitions cheaper, free or even profitable over time.

- In this approach we have a strategic advantage to pure financial lenders. We’re happy to accept a lower return in return for an option to foreclose that asset if the borrower doesn’t pay back. Following this strategy you may want to offer more competitive interest rates (10–40% APY) in order to get offers accepted on valuable pieces from borrowers and “win” the loan. Remember that NFTfi is a p2p marketplace, so the borrower can and will most likely accept the most competitive offer available to them.

- We generally want to make offers on any item we’d like to acquire quickly and be in market most of the time. This is the dominant strategy I have pursued myself on the platform, and one that should offer NFT experts and collectors a real competitive advantage to acquiring in market.

3. Lend safely to friends and people you want to support

A little known and described element of NFTfi is friendly lending. Due to the nature of the platform, you can make any loan offer you want.

The key to making this strategy work is;

- As a secure alternative to private off-the-books lending to friends. While many of us have lent ETH to other NFT users and we generally trust our friends, unforeseen or unfortunate things can and do happen. Even if a friend isn’t outright going to disappoint you by not paying back as agreed, someone may actually lose access to their account, get hacked or something might happen to them in the real world that prevents repayment. All of these scenarios are nightmares, but can be avoided.

- NFTfi offer you a safe and easy way to lend to friends for free, but with with one or several of their NFTs as security in case of anything unexpected. Don’t risk capital and friendships when there is no need to.

- This approach could also be used by patrons that want to lend a larger amount to an artist or a project but feel more comfortable having security for the loan. Despite NFTfi only offering up to 90 day loans at the moment, you could easily stagger 2-4 overlapping loans in a row, each paying back the previous and extending the loan period. Maybe to fund a big project?

All loans on NFTfi are subject to a 5% success fee on the interest paid by the borrower to the lender, but if there was no interest paid due to the loan being interest free or the borrower defaulting, the platform doesn’t take a fee at all.

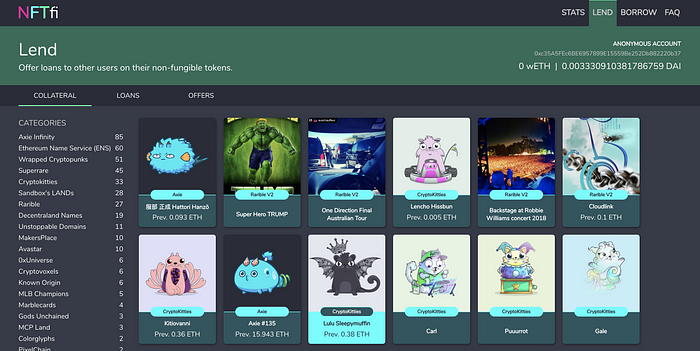

There are over 400 NFTs listed on NFTfi right now waiting for loan offers.

Next weekend we’ll explore the borrowing side of NFTfi in more detail, in the meantime please let us know your thoughts and feedback. Feel free to also join us in our Discord and ask questions in the Offers-and-Appraisals channel if you need help valuing an NFT or evaluating a loan offer.

We’re keen to continue to improve the knowledge of both lenders and borrowers and ensure a responsible and rewarding use of the marketplace.

Disclaimer: None of the content is intended as investment advice, it is only for information and entertainment purposes. Please do your own research on individual NFTs or projects before offering loans or engaging in borrowing.